Financing an energy project in El Salvador is a cumbersome deal. Patience is require as well as great know how in traversing all the legal obstacles that get in the way of an approval.

The banking sector for years has promoted their support for renewable projects. Usually this support has come from better terms in duration or interest rates. But its quite difficult to separate this more green friendly terms with the current market rates abroad.

In this sense, if a bank gives me a lower rate, its not because its supporting a renewable project but because their rates abroad have come down. So even though the cost of capital is lower, nothing else has changed.

There is still a big preferrence in giving loans to big utility scale projects. Its easy, or at least is pretends to be. You just need a buyer, a PPA signed with this buyer and control of the land or roof where you want to build the plant.

This is where the banks feel comfortable – it has taken them year nonetheless. They have been able to do some project finance, trying not to see the business procuring the loan but sizing the projects independently.

A lot of the big projects were born from tenders offer by the distribution companies, which were incentivized and promoted by the goverment. Great relative prices were locked-in at the beginning – now not so much.

With the new prospected generation to be turn on in the next couple of years, the projects with great locked-in prices look to excel, but new projects with less favorable terms could see great margin compresion or even be unprofitable.

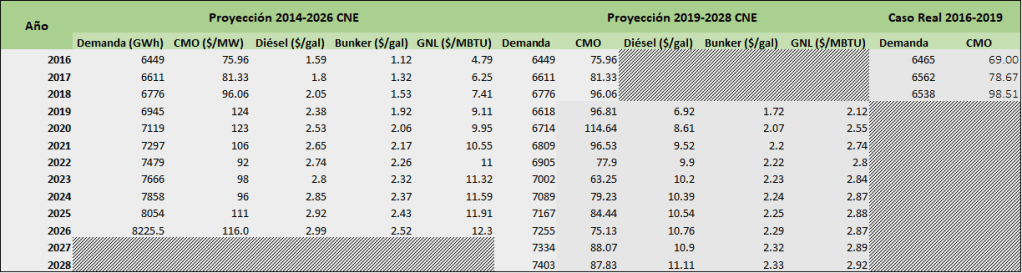

A quick read from the CNE planning documents throws the possible down direction from the current prices. This could be problematic for some.

In this scenario of lower prices for the years to come, we should be happy that lower prices would finally get to the end consumer. But if you look at the real case from 2016-2019 lower average prices have been achieve before all these new plants coming up. So, its not the case that we needed more generation but a more efficient one.

The banking sector still is enamoured -as anyone else would be- of financing big MW projects, but if lower prices are just around the corner, would this be prudent from a credit risk perspective? Just time will tell.